Author

Nominal vs. Real Interest Rates

When performing economic damages analysis, one must decide whether to discount future economic damages to present value using a nominal interest rate or real interest rate. For an investment, the nominal rate is the quoted or stated interest rate. The real interest rate is the nominal rate adjusted for inflation. For example, if a one-year investment has a stated interest rate of 7% per year, and the inflation rate is 3% per year, the “real” interest rate is less than 7% because the purchasing power of the dollar decreases during the year. After accounting for the dollar’s loss of purchasing power, the investor’s real rate of return is only about 7%–3%=4%. The precise relationship between nominal and real interest rates is given by the Fisher equation, named after the economist Irving Fisher.[1] Specifically,

![]()

In the above example, the real interest rate is

![]()

The percentage increase in purchasing power that the investor realizes as a result of buying and holding the investment is 3.883%.

Nominal vs. Real Dollars

In the above example, if the amount invested is $1,000, the value of the investment after one year is $1,000 x 1.07=$1,070 in nominal dollars. The value of the investment in inflation-adjusted dollars, also called real or current dollars, is $1,038.83 after one year. Future economic damages can be calculated using nominal dollars or real dollars. RPC thinks future damages should be calculated using real dollars so amounts are more comparable across years, and so jurors can better understand and interpret the magnitude of damages.

Discounting

The discount rate has a significant impact on the present value of damages. For example, assume in a lost earnings case, there are 20 years of lost wages, with first year lost wages of $50,000, and the real growth rate for wages in subsequent years 0.20%. A discount rate of 1.0% produces a present value of $919,021. The present value using a discount rate of 3.0% is 17.7% lower, $756,699.

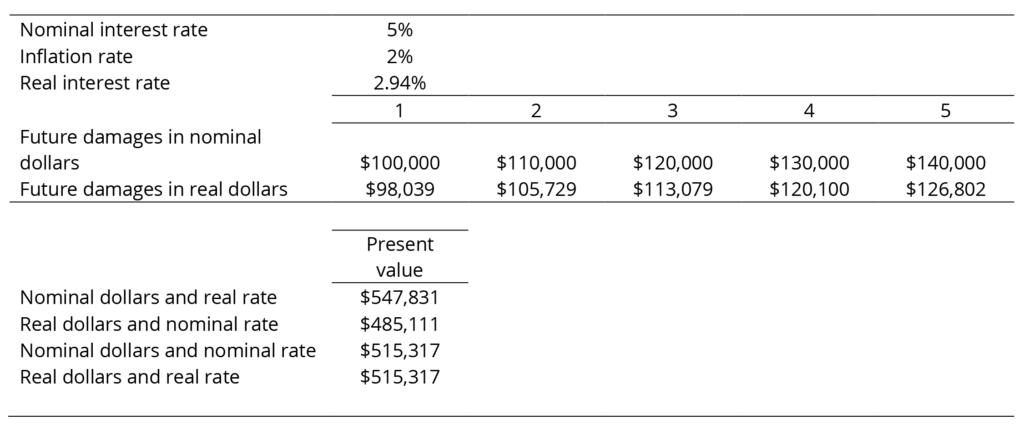

When discounting future economic damages, it is important for the dollars and discount rate to match. Nominal dollars should be discounted using a nominal interest rate, and real dollars should be discounted using a real interest rate.

The example below shows the importance of matching dollars and discount rate. Discounting nominal dollars using a real interest rate will overstate the present value of damages, and discounting real dollars using a nominal interest rate will understate the present value of damages.[2]

Discounting future economic damages assumes that the plaintiff could invest the awarded damages and earn a return such that the combined principal and interest would be sufficient to cover the economic losses each year. In a personal injury case, it is assumed that the plaintiff would invest the proceeds in a safe investment. Consequently, for personal injury cases, RPC uses the real risk-free interest rate to discount economic damages.

Calculating the Real Risk-free Rate

RPC uses historical yields on three-month US Treasury bills to measure the nominal risk-free interest rate. Three-month US Treasury bills are considered to be free of default risk, and they do not have liquidity risk or maturity risk.

To calculate the real risk-free interest rate used to discount economic damages in personal injury cases, RPC applies the Fisher equation using historical yields on three-month US Treasury bills and annual inflation rates for the period 1960–2019. For a given year, the inflation rate is estimated as the percentage change in the Consumer Price Index (CPI). To determine the historical average real risk-free interest rate, RPC uses the geometric average for the annual rates calculated. The historical average real risk-free interest rate for the period 1960–2019 is 0.82%.

RPC’s Economic Damages Analysis Reports

Given the sensitivity of the present value of damages to the discount rate used, RPC believes it is important to have a consistent and transparent methodology for estimating the real interest rate used to discount future economic losses. In its economic damages reports, RPC includes a table that shows historical US Treasury bill yields and inflation rates used, and explains in detail how the discount rate is determined.

[1] Irving Fisher, Appreciation and Interest (New York: Macmillan, 1896)

[2] In this example, real dollars are calculated as ![]()

This blog post addresses one issue in calculating the discounted present value of economic damages. If you have questions about other issues, we are glad to discuss them. Contact Brian Piper, PhD at 512-371-8014 bpiper@rpcconsulting.com