In personal injury and employment litigation, forensic economists calculate the impact of the event on the past earnings and future earning capacity of the plaintiff. One component of this element of damages is the loss of future Social Security retirement benefits. Benefits are usually received after a person reaches full Social Security retirement at age 67.

Opinions differ on how to value Social Security retirement benefits in litigation. Some economists equate their value with the Social Security taxes paid by employees and employers. Others equate the value to the employee’s expected retirement benefit. This leads to two methods used to calculate damages from reduced Social Security retirement benefits:

Marginal contribution method: The marginal contribution method assumes differences in future Social Security taxes pre-injury and post-injury equal the loss of retirement benefits. This method used the sum of the contributions by both the worker and the employer, or 15.3% of the plaintiff’s reduced wages.

Marginal benefit method: The marginal benefit method applies the Social Security Administration’s formulas to pre-injury and post-injury wages to calculate the pre-injury and post-injury retirement benefits and find the difference.

Many forensic economists use the marginal contribution method because they think it is quicker and does not require complete data on past wages. They think the results are similar in discounted present value terms. Thanks to the Social Security Administration’s downloadable detailed benefits calculator, we know their reasons are unsound.

The Social Security Administration makes a benefits calculator free to download at https://www.ssa.gov/OACT/anypia/download.html. The calculator makes it easy to apply the marginal benefit method. The results for certain scenarios are substantially different than the results from the marginal contribution method.

The SSA calculator lets forensic economists efficiently compare the results from the two methods with different variables at play. SSA updates the formulas and data in the calculator annually to reflect changes in regulations and economic projections. It takes only 30 minutes and a few clicks to calculate pre-injury and post-injury Social Security retirement benefits retirement for the plaintiff. The SSA calculator has a variety of customizable features:

- Results are expressed in real or nominal terms

- The projected retirement date can be adjusted for early, full or delayed retirement with correct changes in monthly benefits

- Retirement, survivor or disability benefits can be calculated

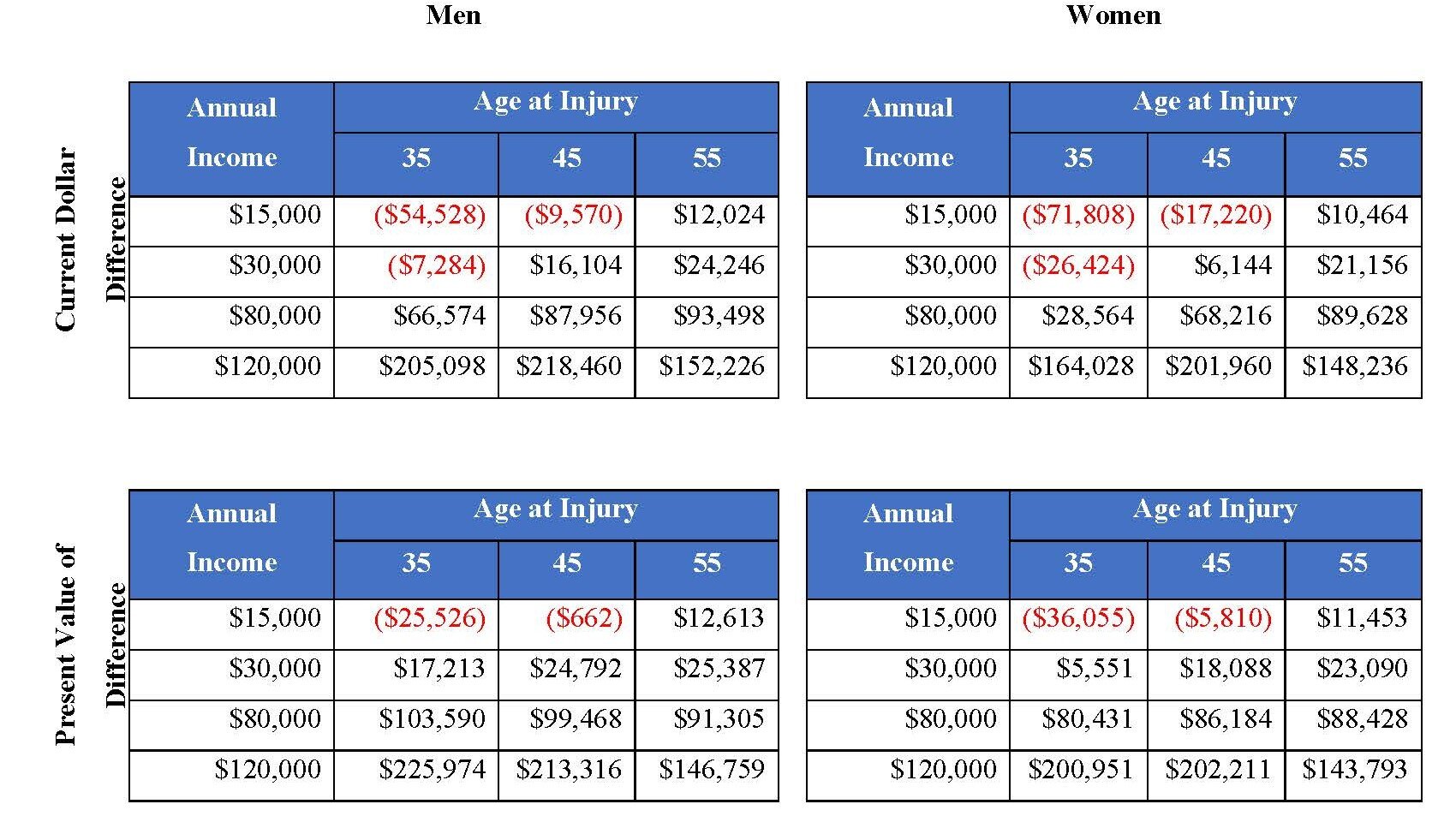

Economists often find that the differences in damage estimates from the two methods are larger than they may have assumed. There are differences in current dollars and in discounted present value. The size of the difference depends on factors like how far the plaintiff is from retirement, and his or her wages prior to the injury. The plaintiff’s gender is also important because of women’s longer life expectancies.

The tables below show the difference in damages between the marginal contribution method and the marginal benefit method. Results are presented in current dollars and in discounted present value. Results are shown for men and women. All calculations assume the plaintiff was born and injured on July 1, will retire at 67 and suffered an injury that led to a total loss of future earnings. Women are expected to receive benefits for 19 years while men are expected to receive benefits for 16.5 years. Positive values indicate that the marginal contribution method estimates higher lifetime benefits than the marginal benefit method.

Differences Between Marginal Social Security Contributions

and Marginal Benefits at Various Income Levels

(Marginal Contribution less Marginal Benefit) (2018)

Even when discounted to present value, the difference between the two methods is usually more than one year’s worth of earnings. The tables show neither method always produces higher benefits. The marginal benefits method generates higher benefits for younger plaintiffs who had lower incomes on the date of injury.

Even when discounted to present value, the difference between the two methods is usually more than one year’s worth of earnings. The tables show neither method always produces higher benefits. The marginal benefits method generates higher benefits for younger plaintiffs who had lower incomes on the date of injury.